Not known Incorrect Statements About Pvm Accounting

Table of ContentsTop Guidelines Of Pvm AccountingThe Of Pvm AccountingNot known Incorrect Statements About Pvm Accounting The Best Guide To Pvm AccountingPvm Accounting Fundamentals ExplainedSome Known Details About Pvm Accounting

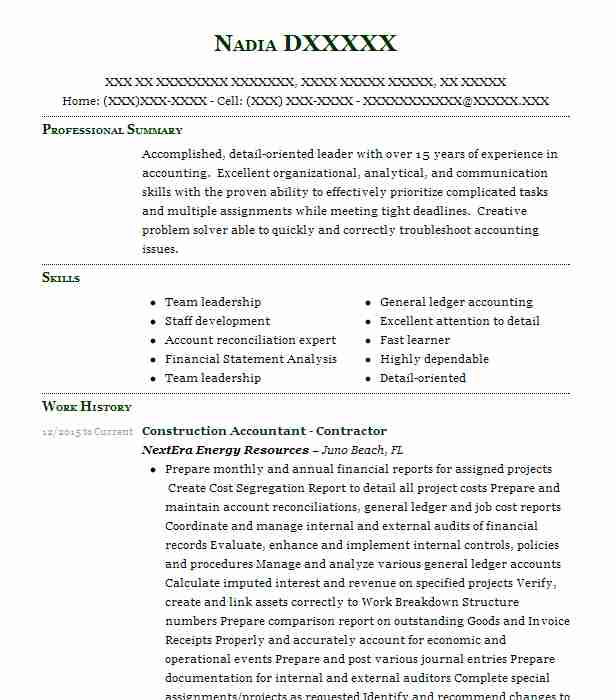

Look after and manage the production and authorization of all project-related invoicings to clients to promote great interaction and prevent concerns. construction accounting. Ensure that appropriate reports and documents are submitted to and are updated with the internal revenue service. Make certain that the audit process follows the legislation. Apply needed building and construction accounting requirements and procedures to the recording and coverage of building activity.Interact with numerous funding companies (i.e. Title Business, Escrow Business) concerning the pay application procedure and needs required for payment. Aid with executing and maintaining inner financial controls and procedures.

The above statements are meant to describe the basic nature and degree of work being done by individuals appointed to this category. They are not to be construed as an extensive checklist of obligations, duties, and abilities needed. Employees may be needed to do obligations outside of their normal duties every so often, as required.

The Main Principles Of Pvm Accounting

Accel is looking for a Building and construction Accounting professional for the Chicago Office. The Construction Accounting professional carries out a range of accountancy, insurance coverage conformity, and task administration.

Principal responsibilities consist of, yet are not limited to, managing all accounting functions of the business in a prompt and exact way and giving reports and schedules to the firm's CPA Company in the prep work of all financial statements. Ensures that all accounting procedures and features are taken care of accurately. Accountable for all financial records, pay-roll, banking and everyday operation of the audit feature.

Prepares bi-weekly test equilibrium records. Functions with Project Managers to prepare and publish all monthly invoices. Procedures and issues all accounts payable and subcontractor settlements. Produces month-to-month wrap-ups for Employees Settlement and General Responsibility insurance coverage premiums. Generates monthly Job Cost to Date reports and dealing with PMs to reconcile with Task Managers' allocate each task.

The 3-Minute Rule for Pvm Accounting

Effectiveness in Sage 300 Building and Property (formerly Sage Timberline Office) and Procore construction monitoring software application an and also. https://www.twitch.tv/pvmaccount1ng/about. Should additionally excel in various other computer system software application systems for the preparation of records, spread sheets and other audit evaluation that may be called for by administration. construction accounting. Must have strong business skills and capability to prioritize

They are the monetary custodians who guarantee that building and construction jobs remain on budget plan, follow tax guidelines, and preserve economic openness. Building accounting professionals are not simply number crunchers; they are tactical partners in the building procedure. Their primary role is to take care of the financial elements of building and construction projects, guaranteeing that sources are alloted successfully and financial risks are reduced.

Getting My Pvm Accounting To Work

By keeping a limited hold on project funds, accounting professionals assist protect against overspending and monetary troubles. Budgeting is a keystone of effective construction tasks, and construction accounting professionals are instrumental in this respect.

Navigating the complicated web of tax laws in the building and construction market can be difficult. Construction accounting professionals are fluent in these policies and make sure that the task follows all tax obligation needs. This includes handling payroll tax obligations, sales taxes, and any kind of other tax obligation responsibilities certain to building. To master the role of a construction accounting professional, individuals require a strong instructional structure in accounting and financing.

Furthermore, accreditations such as Certified Public Accounting Professional (CPA) or Licensed Building Market Financial Expert (CCIFP) are highly related to in the market. Construction projects frequently entail tight due dates, changing guidelines, and unforeseen expenses.

Pvm Accounting Can Be Fun For Everyone

Expert certifications like CPA or CCIFP are likewise very advised to demonstrate expertise in building audit. Ans: Building accounting professionals create and monitor budgets, identifying cost-saving possibilities and guaranteeing that the job stays within spending plan. They additionally track expenditures and forecast economic requirements to stop overspending. Ans: Yes, building and construction accounting professionals take care of tax conformity for building and construction tasks.

Intro to Construction Audit By Brittney Abell and Daniel imp source Gray Last Updated Mar 22, 2024 Construction companies need to make challenging options among numerous financial options, like bidding process on one task over one more, picking funding for materials or tools, or establishing a project's profit margin. In addition to that, building and construction is a notoriously unpredictable sector with a high failure rate, slow time to settlement, and inconsistent cash circulation.

Production involves duplicated processes with quickly recognizable prices. Manufacturing calls for various procedures, materials, and equipment with differing expenses. Each job takes location in a brand-new location with differing website conditions and one-of-a-kind difficulties.

All about Pvm Accounting

Constant use of various specialized specialists and providers impacts efficiency and cash flow. Payment gets here in complete or with normal payments for the complete contract amount. Some section of settlement may be withheld till project completion also when the professional's job is finished.

Normal production and short-term contracts result in convenient capital cycles. Uneven. Retainage, slow repayments, and high in advance expenses bring about long, uneven capital cycles - construction bookkeeping. While standard makers have the advantage of controlled atmospheres and enhanced production procedures, building and construction firms have to regularly adjust to each new task. Even somewhat repeatable projects need alterations because of website problems and various other elements.

Comments on “Pvm Accounting Fundamentals Explained”